Mortgage Rates Dipped Slightly to a Nearly Three-Year Low Because of Concern About a Potential Global Economic Slowdown and Some Weak Home Sale News.

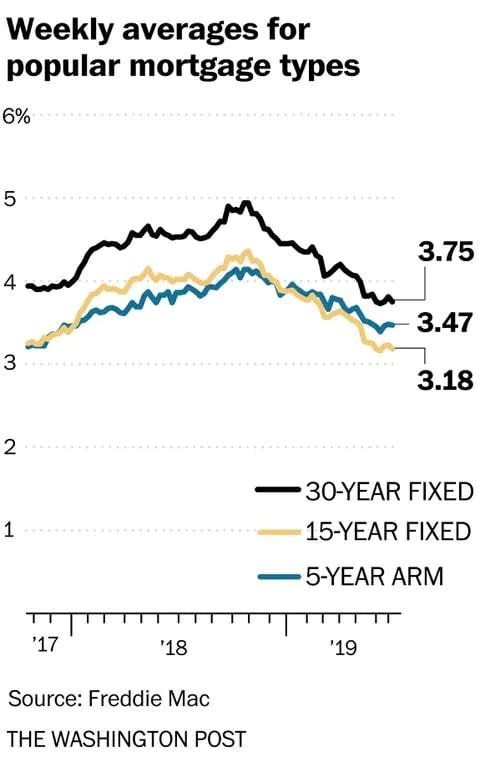

According to the latest data released Thursday by Freddie Mac, the 30-year fixed-rate average fell to 3.75 percent with an average 0.5 point. (Points are fees paid to a lender equal to 1 percent of the loan amount and are in addition to the interest rate.) It was 3.81 percent a week ago and 4.54 percent a year ago.

The 15-year fixed-rate average declined to 3.18 percent with an average 0.5 point. It was 3.23 percent a week ago and 4.02 percent a year ago. The five-year adjustable rate average dropped to 3.47 percent with an average 0.4 point. It was 3.48 percent a week ago and 3.87 percent a year ago.

“This is good news for buyers, particularly when you compare rates to a year ago,” said Danielle Hale, chief economist for Realtor.com. “Based on a typical listing of $316,000 with a 20 percent down payment, buyers today would pay $112 less for their principal and interest than they did a year ago.”

However, she said, that doesn’t account for rising home prices.

“If you factor in the higher price that buyers are paying this year compared to a year ago, you’re still looking at a savings of $48 per month compared to what buyers would have paid for the average house at this time last year,” Hale said.

On the other hand, she said, falling mortgage rates can be an indication of a weaker economy, which could have a negative impact on the housing market going forward.

Weekly averages for popular mortgage types

However, Sam Khater, Freddie Mac’s chief economist, said in a statement that he expects the lower mortgage rates to positively impact the housing market soon.

“Mortgage rates continued to hover near three-year lows and purchase application demand has responded, rising steadily over the last two months to the highest year-over-year change since the fall of 2017,” he said. “While the improvement has yet to impact home sales, there’s a clear firming of purchase demand that should translate into higher home sales in the second half of this year.

Analysts are also watching to see whether a potential move by the Federal Reserve next week to lower the benchmark interest rate to 2.1 percent from 2.35 percent would impact mortgage rates. Michael Borodinsky, vice president of Caliber Home Loans in Edison, N.J., said if that happens, mortgage rates wouldn’t necessarily drop as well.

“The Federal Open Market Committee monetary policy only directly impacts short-term interest rates,” Borodinsky said. “Mortgage rates are directly impacted by the direction of longer-term fixed-income instruments such as Treasury bonds and mortgage backed securities.”

Bonds are traded daily, he said, and rise or fall based on current economic data and, more importantly, in anticipation of what traders believe will be the likely move by the Federal Reserve.

“For example, traders have pushed bond yields and mortgage rates lower over the past few months on anticipation that the Fed will lower rates at the upcoming meeting next week,” Borodinsky said. “So the likely rate reduction is already factored into current mortgage rates. Not only that, the markets believe that there will be further rate cuts over the coming months.”

For potential borrowers who want to know what to expect from mortgage rates, the answer is uncertain.

“Traders will be looking at not only the Fed rate move but guidance as to what will influence their future actions,” Borodinsky said. “For example, does the Fed see an upcoming slowdown in economic data pointing to a future recession? That will likely mean deeper cuts in current short term rates and bond yields and mortgage rates would likely follow suit. On the other hand, if the Fed announces that they believe that the upcoming rate cut will be sufficient to sustain current economic strength, traders may be disappointed and trade bonds in the opposite direction and as a result, we would see mortgage rates reverse their downward trend and move higher.”

Meanwhile, mortgage applications declined. According to the latest data from the Mortgage Bankers Association, the market composite index — a measure of total loan application volume — dropped 1.9 percent from a week earlier. The refinance index decreased 2 percent from the previous week, while the purchase index fell 1 percent.

The refinance share of mortgage activity accounted for about half of all applications.

“Mortgage applications were down last week, even as rates moved lower across the board,” Joel Kan, MBA’s associate vice president of economic and industry forecasting, said in a statement.

“Refinance activity was lower, but we did see government refinance applications increase, driven solely by a 12 percent rise in FHA applications,” he added. “Mortgage rates right now are comparable to the average rate of 4.10 percent for June, but refinances last week were 7 percent lower than last month. This is an indication that as we see rates lower for longer, borrowers need more of a drop in rates to consider refinancing.”