The Federal Reserve on lifted its benchmark rate by a quarter of a percentage point, the second hike this year, according to CNN Money.

And a majority of policy makers said they now expect a total of four interest rate increases this year. Fed officials had been split about whether to raise rates three times this year or four.

The decision reflected an economy that’s getting even stronger. Unemployment is 3.8%, the lowest since 2000, and inflation is creeping higher. The Fed is raising rates gradually to keep the economy from overheating.

“The main takeaway is that the economy is doing very well,” Fed Chairman Jerome Powell said at a news conference. “Most people who want to find jobs are finding them, and unemployment and inflation are low.”

Related: Unemployment rate matches lowest point in half a century.

The Fed lifted the federal funds rate, which helps determine rates for mortgages, credit cards and other borrowing, to a range of 1.75% to 2%.

“By just tapping the brakes more quickly, but not harder, the Fed is showing it’s willing to let the economy and the expansion run,” said Robert Frick, corporate economist with Navy Federal Credit Union.

Higher Borrowing Costs

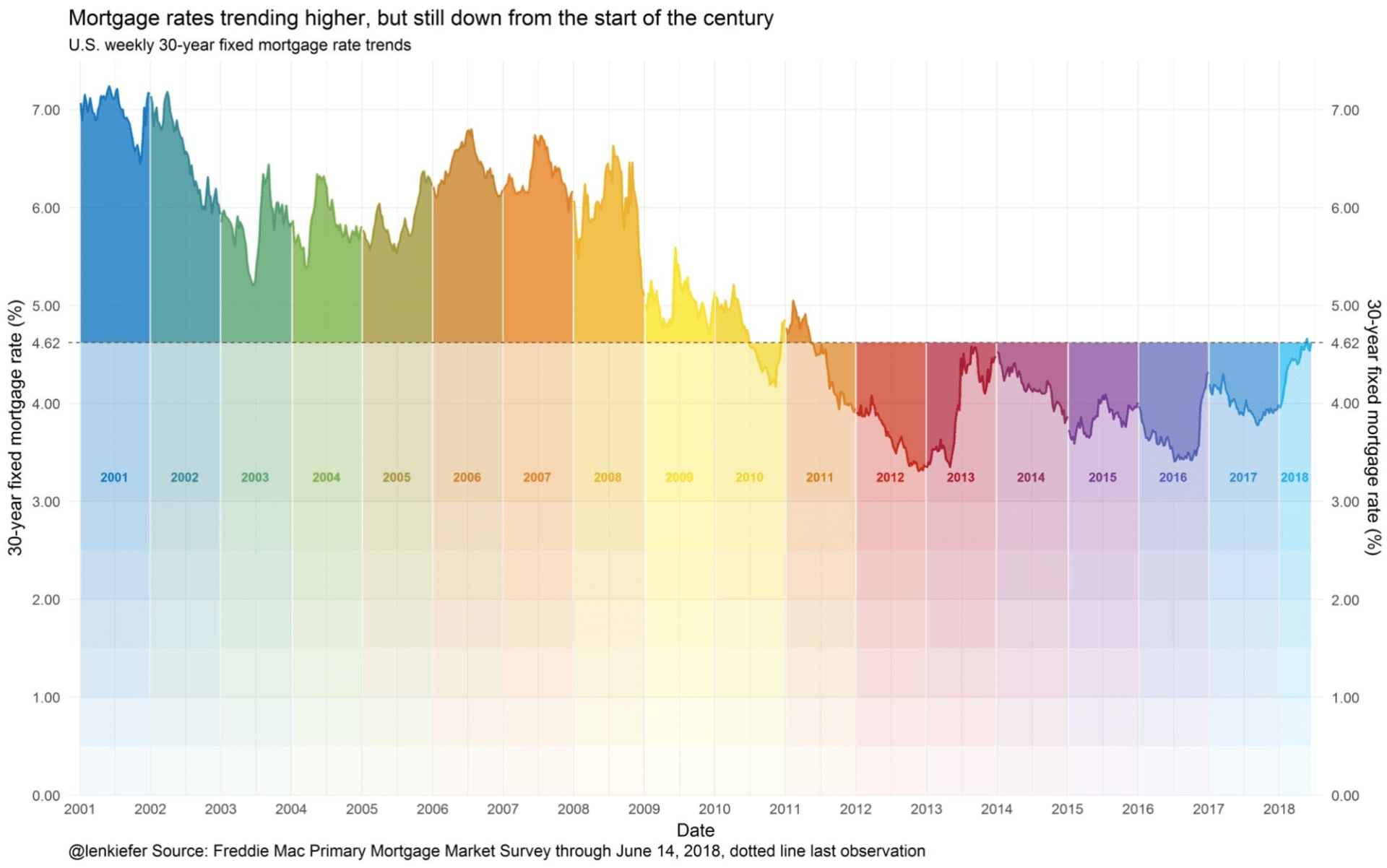

Mortgage rates have been climbing. The average rate on a 30-year fixed rate mortgage climbed to 4.66% this year in May, the highest in seven years, before falling slightly in recent weeks.

“Home mortgage rates tend to move with the bond market, but rates can also rise because of a higher federal funds rate. A higher rate makes it more expensive for banks to borrow money, which can translate into higher borrowing rates for consumers.

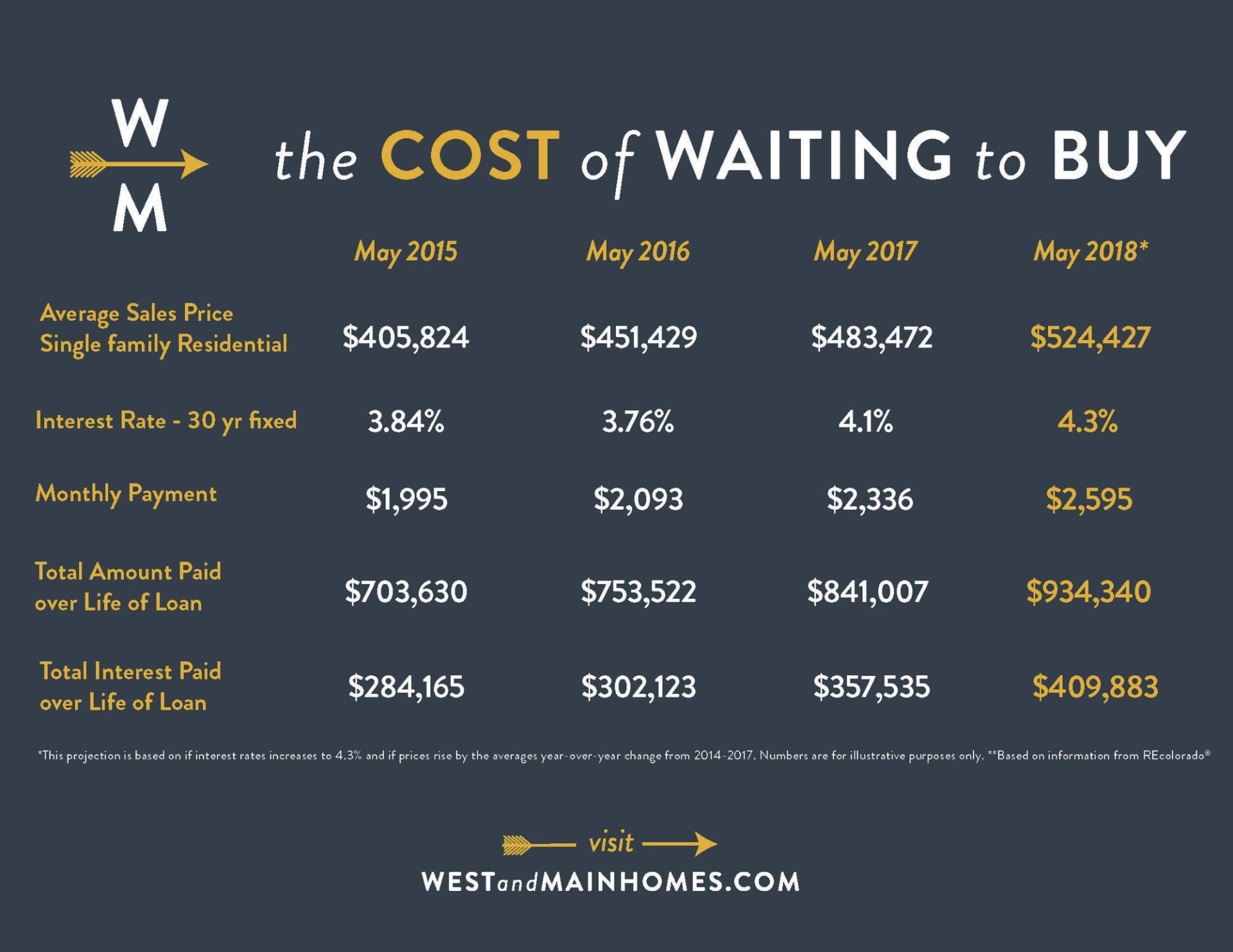

Yesterday The Federal Reserve announced their decision to raise Prime Rate from 4.75% to 5%. Mortgage markets expected this increase, so we shouldn’t see much movement in home lending rates short term. We didn’t expect to hear hints of two more potential Prime Rate hikes this year and that has me nervous for buyers who are on the fence.

The Prime Rate increase affects buyers with consumer debt they are carrying into the buying process, including student loans, credit card payments, existing Home Equity Lines of Credit (HELOC) and new car purchases. This Prime Rate adjustment will increase those payments, affecting their DTI (debt to income) ratios, resulting in a loss of purchase price they can qualify for.

My team at OnQ Financial are motivating our buyers to move off the fence, get under contract on a home and lock the interest rate. The waiting game is over in my opinion. “ – Chad Humphrey, OnQ Financial

In the bond market, too, investors are showing signs of concern about higher inflation and faster rate hikes. The yield on the 10-year Treasury note recently hit the highest level in almost seven years.

The Fed’s decision Wednesday was driven by “indications that inflation is right around the corner,” said Jason Reed, an economist and finance professor at the University of Notre Dame’s business school.

Inflation has been mysteriously low during the long economic recovery. But it has finally passed 2%, the level the Fed considers healthy.

The Fed’s preferred measure of inflation, which strips out food and energy prices, climbed in May to 2.2% and registered the biggest annual jump in six years. The Fed expects inflation higher than 2% over the next two years, according to its latest projections. Powell said the Fed would be worried if inflation either persistently overshoots or undershoots the 2% target. He pointed out that inflation can “bounce around” over time, especially with a spike in global oil prices likely to raise prices.

An Ever-improving Economy

Fed officials have begun to debate publicly how close the economy is to overheating. They offered an improved forecast for unemployment this year, lowering their forecast to 3.6%. They forecast an even lower unemployment rate of 3.5% for 2019 and 2020.

Employers have added jobs every month for seven and a half years, a record. And for the first time in at least 20 years, there are more job openings in the United States than there are people looking for work.

Powell said it’s been a “bit of puzzle” why wages haven’t risen faster, but he expressed optimism that American workers will see fatter paychecks as more go back to work.

“Most people who want to find a job can find one,” he said. “I think overall we have a really solid economy on our hands here.”

Read more on CNN Money.

If you have questions about how rising interest rates will impact your buying power or home search, contact us.