Fannie Mae recently released their “What do consumers know about the Mortgage Qualification Criteria?” Study. The study revealed that Americans are misinformed about what is required to qualify for a mortgage when purchasing a home. Here are three takeaways:

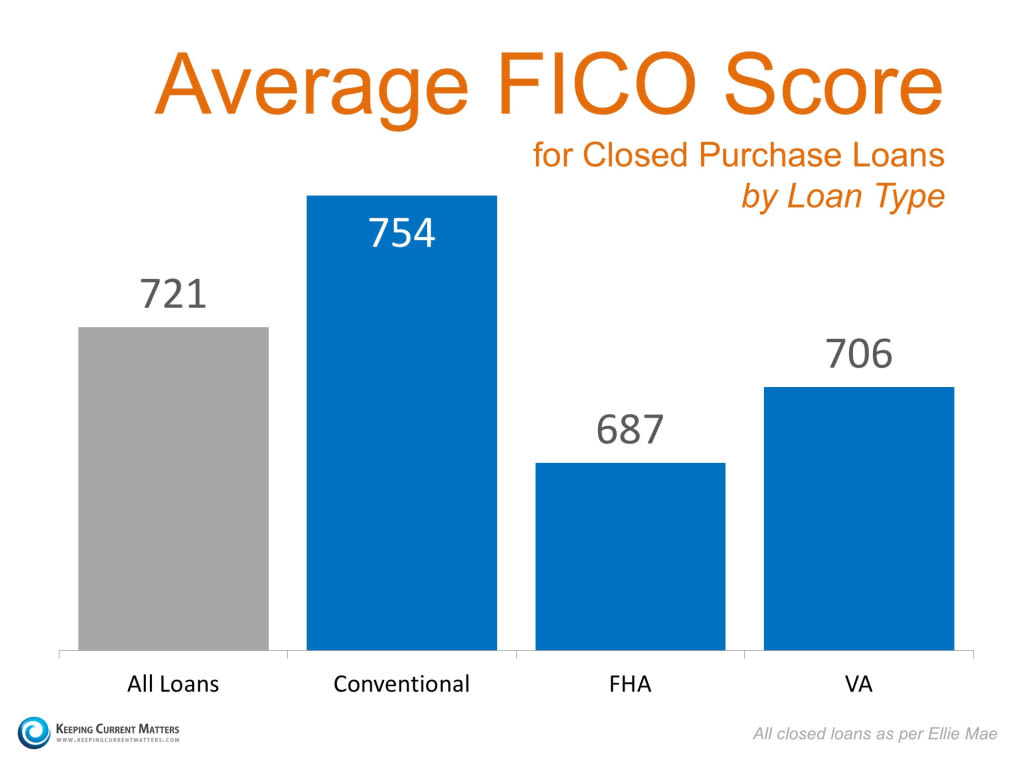

- 59% of Americans either don’t know (54%) or are misinformed (5%) about what FICO score is necessary

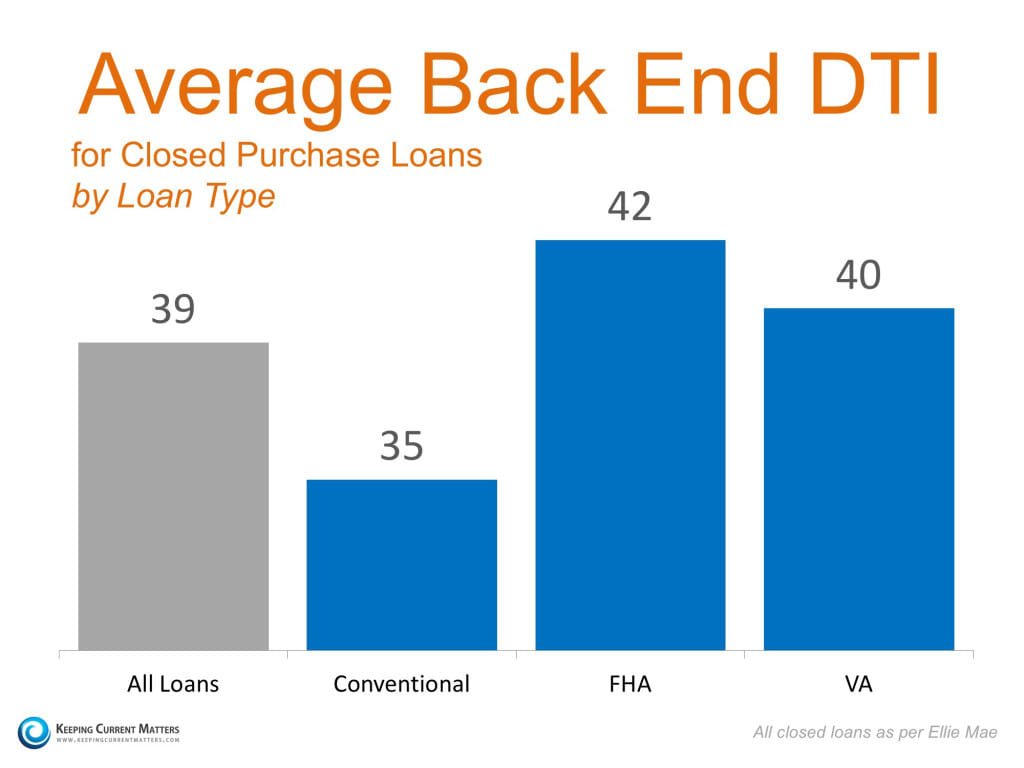

- 86% of Americans either don’t know (59%) or are misinformed (25%) about what an appropriate Back End Debt-to-Income (DTI) ratios is

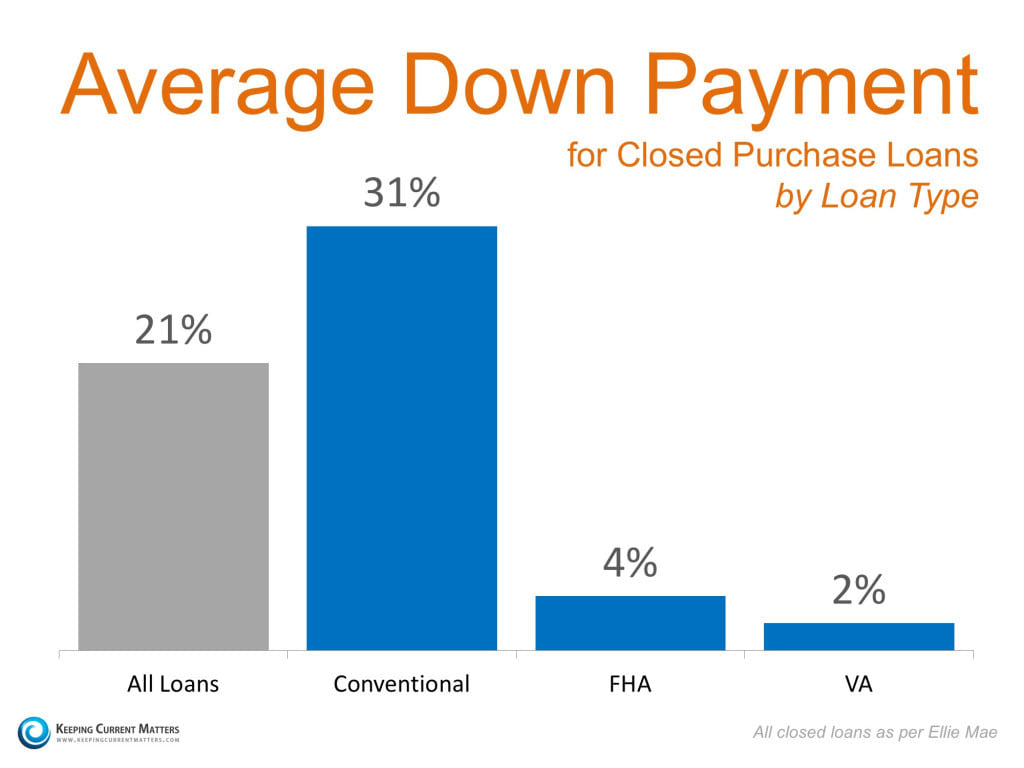

- 76% of Americans either don’t know (40%) or are misinformed (36%) about the minimum down payment required

It’s always a priority of mine to make sure my clients are well informed with real examples and factual information. To help correct these misunderstandings, let’s take a look at the latest Ellie Mae Origination Insight Report, which focuses on recently closed (approved) loans.

FICO SCORES

BACK END DEBIT TO INCOME

DOWN PAYMENT

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will definitely make the mortgage process easier. Your dream home may already be within your reach.

Also, please please please help spread the word. If a co-worker, family member or friend has misunderstood any of this information I’m happy to talk them through it or feel free to share this blog.